Over the course of the last 30 years or so, the interest rates credited to permanent life insurance policies for the most part have dropped. When the companies introduced their Universal Life Insurance policies in 1984, the interest rate was almost 12%; since that time, the current interest rate has dropped. Today the current rate is approximately 3%.

Whole Life policies operate somewhat differently than Universal Life Insurance policies. The underlying investment returns are just one component of any dividends that a whole life policy may receive. Dividends represent a return of premium that is dependent on not just the insurance company’s investment returns, but also the gains in the mortality and expenses where the company’s actual experience proves less costly than what was illustrated. Typically, in Variable Life and Variable Universal Life Insurance (VUL) policies, the investment returns depend on the performance of the separate accounts chosen by the policy owner based on risk tolerance, liquidity needs, time horizon and goals for the policy. The separate accounts are managed by fund managers and can invest in a mix of stocks, bonds, or other products based on the investment and risk tolerances of the underlying fund.

Lower returns on the underlying investment of the life insurance policies purchased may cause actual policy cash values to be lower than the original illustrated values. If investment returns lag for an extended period of time, the policy may lapse, or a higher premium may need to be contributed for the policy to reach the original goals.

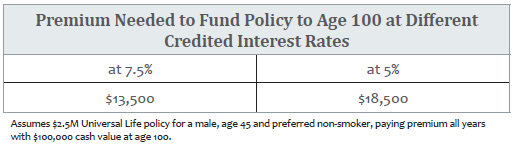

As you can see from the table to the right, the investment return in the policy can dramatically affect the amount of premium that needs to be contributed to reach a goal.

The analysis above shows the effect of an interest crediting rate on the performance of a Universal Life policy. The 7.5% credited rate approximates the rate paid on UL policies two decades ago. The 5% rate is in line with what most UL policies are crediting today. As you can see, it would take approximately 35% more premium at the lower interest rate to keep the policy from lapsing before age 100, assuming the lower interest rate and the lower premium funding the policy lasts only to age 83 which is less than expected mortality.

Speak with an experienced advisor! 212-573-5563

Speak with an experienced advisor! 212-573-5563