There are three major factors that affect the performance of a life insurance policy:

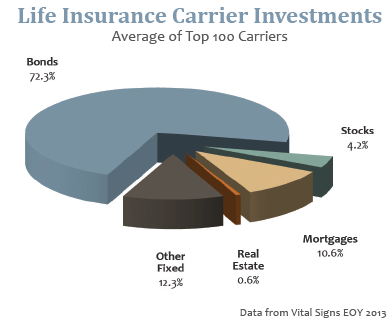

- The first is the interest rate return on the underlying investment that provides the cash value in the policy. In Universal Life (UL) and Whole Life (WL) policies, the investment account is an insurance company-directed investments. As you can see from the chart on the right, it consists mostly of bonds, with some real estate assets. In Variable and Variable Universal Life (VUL) policies, the cash value is invested in separate accounts with the asset classes chosen by the policy owner.

- The second factor is the amount of expenses in the policy, including the acquisition costs (commissions, underwriting expenses, etc.).

- The tertiary factor is the actual mortality charges within the policy.

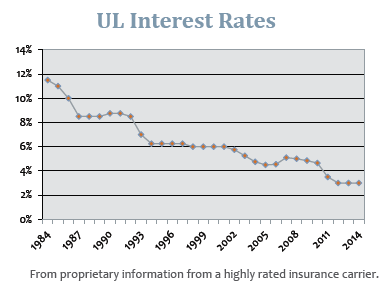

Of the three factors noted, the one that most significantly affects the actual performance of the policy compared to the projected values in the sales illustration is the interest rate that is obtained. The actual expenses and mortality charges used in original illustrations are easier to predict than the investment return. In all illustrations, there is an assumed projection and a guaranteed projection. The assumed projection is an estimation of what will occur in the policy going forward using the current assumptions for expenses, mortality, and investment return. The guaranteed projection uses only those factors that are guaranteed when it projects the outcome. If the actual current interest rate that is obtained in the policy is less than the projected rate, the policy will not perform as well as expected.

Speak with an experienced advisor! 212-573-5563

Speak with an experienced advisor! 212-573-5563