If you’re reading this article, you have most likely taken a great first step in protecting yourself and your family – obtaining a life insurance policy. First off, congratulations on acquiring a life insurance policy to keep your family or business financially secure. During the life insurance buying process, you probably went through basic questions to determine how much life insurance you personally needed and what type of policy was best for you at the time of purchase. How often do you review your life insurance policy with the agent who sold it to you or your financial advisor? According to a James Andrews authored article, it is a good habit to review your policy on an annual basis. Some benefits of reviewing your policy are:

- Making sure that you are properly covered

- Verifying that the beneficiaries listed are up to date

- Ensuring that your policy is still the most beneficial one for you on the market

- Confirming that your policy is not in danger of lapsing

What are the different types of life insurance?

In an ideal world, you would be able to recite all of the tiny print that was written on your life insurance policy swiftly and accurately. In reality, hopefully, you are aware of the prominent features of your life insurance policy. There are two main types of life insurance – temporary and permanent. Under the temporary branch of insurance are varying lengths of Term Life insurance policies, while under the permanent branch of insurance there are various products, each with their pros and cons. Three of the main types of permanent life insurance are Whole Life Insurance, Universal Life Insurance, and Variable Life Insurance. So, what makes one kind of life insurance better than another? Well, one kind is not necessarily better than another one but, one might fit your personal needs better than another type. Here are brief descriptions of different kinds of policies:

Term Life Insurance

Term life insurance is considered the most straightforward of life insurance. This type of life insurance offers a pure death benefit protection only for a period of time, without any cash value building up within the policy. Thus, term life insurance is often very affordable – especially for those applicants who are younger and in good health at the time they apply for the coverage.

Whole Life Insurance

Whole life insurance is the most common type of permanent insurance policy. In addition to providing a financial death benefit to your beneficiaries upon your death, the coverage comes with guaranteed cash value during the life of the policy. This is accomplished by applying part of each premium payment to the policy’s cash-value account, which grows on a tax-deferred basis. The policyholder can withdraw the cash value as it accrues and uses it as he or she sees fit under certain circumstances.

Universal Life Insurance

Universal life insurance is a permanent life insurance that offers more flexibility than whole life insurance. Similar to Whole Life Insurance, Universal life insurance provides a savings vehicle, the cash-value account, which generally earns a rate of interest. The policyholder can withdraw or borrow against the cash value account as provided for in the policy. Universal life policies may also give the policyholder the option of adjusting the amount of their death benefit or premium payments as their needs change, which can be helpful in turbulent economic times. Each life insurance company and their individual products have different rules regarding these options, brushing up on your product’s unique features is a good idea during your annual review.

Variable Life Insurance

Variable life insurance is also a form of permanent life insurance coverage. This type of life insurance policy offers a death benefit, as well as a cash-value account. However, with variable life insurance, the policyholder has control of how the cash value of the life insurance is allocated based on the different options provided by the insurance company. This means that their funds have the chance to grow a great deal more than the funds in a whole life policy can. Therefore the cash value is prone to ups and down as the economy expands and shrinks.

Life Insurance Policies Don’t Lapse Often, Right?

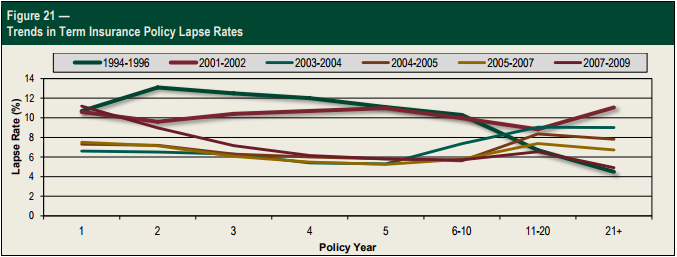

As long as you keep paying the premiums, there is no way that your life insurance policy can lapse, right? Unfortunately, this is not true for all life insurance policies. For Term Life Insurance, as long as you pay your premiums according to the payment structure that was agreed upon when signing the contract your policy will not lapse. However, approximately 11% of Term Life Insurance policies lapsed during the first policy year during a 2007-2009 study from LIMRA.

US Individual Life Insurance Persistency, A Joint Study Sponsored by Society of Actuaries and LIMRA 2012

How Can a Life Insurance Policy Lapse?

Failure to pay your premium on time can lead a policy to lapse. Furthermore, all term life insurance policies allow some sort of grace period for making your premium payment. The grace period is the time after a missed insurance premium is due, where a life insurance policy will not lapse even though the payment is past due. The most common length is 30 days. Keep in mind each company has its own guidelines and you should refer to your policy to verify the grace period and specific rules.

Due to the cash value accounts in permanent policies, the risk of lapsing these policies are more difficult to decipher. For example, even if you are disciplined in paying your premiums in a timely manner, your policy may be in danger of lapsing. How can this be? One reason could be due to the performance of the cash-value account being lackluster. Since each policy is based on the cash-value accounts performing to a certain level, if the cash-value accounts do not hit their projected goals the policy could be in danger of lapsing. Two other factors that can affect the performance of life insurance policy are the amount of expenses in the in policy (such as commissions, underwriting expenses, etc.) and the actual mortality charges within the policy. Therefore, reviewing how your permanent life insurance policy is performing is vital in protecting against the risk of your policy lapsing.

What Happens When a Life Insurance Policy Lapses?

When a life insurance policy lapses the insured is no longer covered by the insurance company. As previously stated, the policy will have to go through a grace period before the policy officially lapses and is no longer active. For some period (depending on company and policy type) after a policy first lapses, the owner may have the option to reinstate the policy. You should try to make sure that you reinstate your policy as quickly as possible after a lapse.

Different companies have different rules for reinstatement. The reinstatement period is very important to policy owners and insured persons for a couple of reasons. The insured person may not need to go through the underwriting process. The second reason the reinstatement period is very important is that even with the same health rating, a new life insurance policy will always be more expensive than an old policy because the insured person has aged. The older the insured person, the higher the rates will be, all else being equal. The bottom line is: reinstating a life insurance policy rather than taking out a new policy will save money.

Speak with an experienced advisor! 212-573-5563

Speak with an experienced advisor! 212-573-5563